Why study risk management?

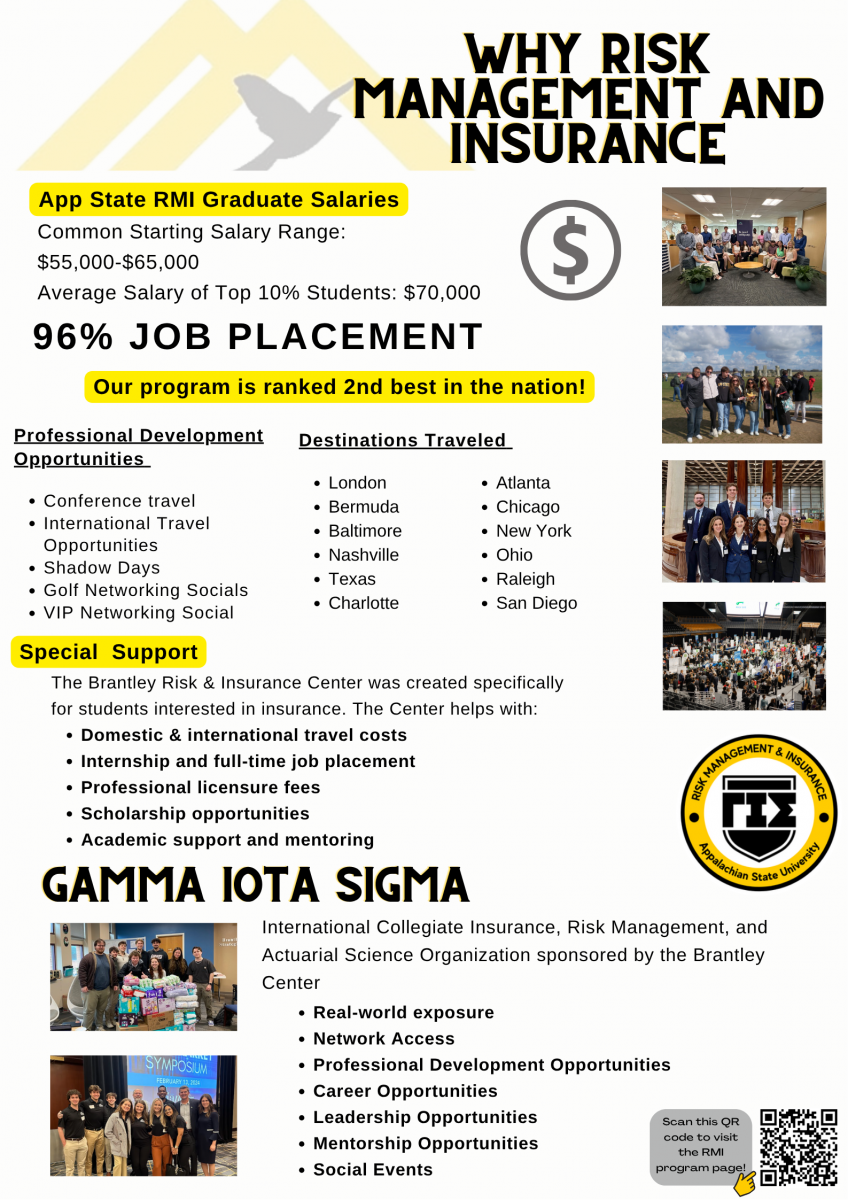

Insurance is a global industry that employs over 2.3 million people in the United States alone and boasts high job satisfaction and opportunities for rapid growth for young professionals. However, in recent years the number of graduates from the nation's RMI programs met only 10-15% of the industry's needs.

Potential careers in the industry span a variety of subjects and prospective fields of expertise including claims, underwriting, actuarial science, sales, customer services, brokerage, employee benefits, human resources, and information technology systems. Since there are so many career paths, there are also many different work environments. The potential work environments range from office, home, and field settings and can allow you to work hand-in-hand with customers or on individual assignments.

See what some of our successful AppState graduates have to say here.

Major in Risk Management & Insurance

A Bachelor of Science in Business Administration (BSBA) with a major in risk management and insurance (RMI) consists of 21 hours in addition to the College of Business core courses required for the BSBA degree. See the 25'-26' bulletin here.

RMI Major: Required Courses (15 hours):

- FIN 3100 - Principles of Risk Management and Insurance (3)

- FIN 3990 - Financial Analysis Using Computer Applications (3)

- FIN 3150 - Commercial Insurance (3)

- FIN 4700 - Insurance Operations (3)

- FIN 4950 - Enterprise Risk and Insurance Management (3)

Electives (Choice of 6 hours) :

- FIN 3600 - Personal Insurance (3)

- FIN 3690 - Financial Management (3)

- FIN 3700 - Employee Benefits (3)

- FIN 3890 - Survey of Investments (3)

- FIN 3900 - Internship (3-9)

- FIN 4770 - Derivatives and Financial Risk Management (3)

- FIN 4800 - International Insurance Markets (3)

- FIN 4850 - FinTech/InsureTech (3)

- ACC 3580 - Individual Income Taxation (3)

- ENT 3060 - Design Thinking and Entrepreneurial Mindset (3)

- LAW 3960 - Insurance Law (3)

- MGT 3620 - Human Resource Management (3)

- MKT 3215 - Professional Selling (3)

- SCM 3660 - Principles of Supply Chain Management (3)

Risk management and insurance majors can use electives to pursue the certificate in financial planning and/or double major.

If an internship (6 credit hours) is elected, three hours will count towards the electives.

Free Electives (15 hours)

- 2 hours any level outside Walker College

- 13 hours any level inside or outside Walker College

Minor in Risk Management & Insurance

The risk management and insurance (RMI) minor consists of 15 hours of coursework and is available to actuarial science majors and business majors (who are not already majoring in RMI). The '25-'26 bulletin can be found here.

RMI Minor: Required Courses (9 hours)

- FIN 3100 - Principles of Risk Management and Insurance (3)

- FIN 3150 - Commercial Insurance (3)

- FIN 4700 - Insurance Operations (3)

Electives (Choice of 6 hours) :

- FIN 3700 - Employee Benefits (3)

- FIN 3990 - Financial Analysis Using Computer Applications (3)

- FIN 4770 - Derivatives and Financial Risk Management (3)

- FIN 4800 - International Insurance Markets (3)

- FIN 4850 - FinTech/InsureTech (3)

- FIN 4950 - Enterprise Risk and Insurance Management (3)

Getting a Double Major with RMI

Due to the nature of the Risk Management and Insurance field, there is a benefit of adding RMI as a double major to other topics. We regularly see students in Finance & Banking, Hospitality and Tourism Management, Management, the Marketing Sales concentration, and Computer Information Systems add the major or minor to their course of study to position them towards different areas of the insurance and risk management field. For example, as cybersecurity is booming around the the world, there are many positions opening that are focused on providing cybersecurity insurance. Having a background in RMI and cybersecurity would make a student very marketable for a role as a cybersecurity insurance broker or underwriter.

The most common double major for RMI is with Finance and Banking. Due to the similarities in the financial markets, pairing those majors together can open up additional career opportunities for both RMI and Finance and Banking students! Additionally, there are many classes that overlap, so adding RMI to one's Finance and Banking major only adds 3 additional courses. Here are the classes that count for each major:

- FIN 3100- Princples of Risk Management and Insurance- Required for RMI major and is a Set 2 Elective for Finance and Banking

- FIN 3990- Financial Analysis using Computer Applications- Required for RMI and Finance and Banking Major

- FIN 3690- Financial Management- Elective for RMI and Required for Finance and Banking Major

- FIN 3890- Survey of Investments- Elective for RMI and Required for Finance and Banking Major

- FIN 4850- FinTech/InsureTech- Elective for RMI and Finance and Banking Major

Ready to Make the Switch?

Considering majoring or minoring in RMI? Ready to make the switch? Current major or minor with questions or concerns?

Contact us today! We are happy to answer your questions and get you connected with all that the risk management and insurance course of study - and the Brantley Risk & Insurance Center - has to offer.

Dillon Waschenbach

Associate Director, Brantley Risk & Insurance Center

Email: waschenbachd@appstate.edu

Call: 828-262-6179

OR

Fill out a quick interest form and we'll reach out to you.